Category: Insights

-

MiFID II & SFDR Compliance: Is Your Documentation Up to Requirements?

Many investment firms face challenges in complying with regulations like MiFID II and SFDR, as key documentation remains scattered and informal. ResearchPool provides a centralized solution, integrating with Microsoft Office to organize emails, notes, and documents efficiently. Its robust permissioning, version control, and customizable workflows help streamline compliance efforts for investment firms.

-

2025, the Crucial Year for Active Investment Management to Fully Embrace Automation

2025, the Crucial Year for Active Investment Management to Fully Embrace Automation Feb 26, 2024 — by ResearchPool in Insights As the 2025 budgeting process begins, prioritizing the automation of processes and workflows is crucial for protecting assets under management and maintaining margins for active investment managers. With technology now mature enough to handle many…

-

Is Disorganized Data Impairing Decision Making in Investment Management?

ResearchPool helps firms manage and organize their data from emails, calls, and documents, preventing missed opportunities due to disorganized information. By integrating with Microsoft Office tools like Outlook and Excel, it centralizes and tags data, preparing it for human and AI-driven insights, boosting investment decision-making and efficiency.

-

Investment Management: Embrace Data Automation

In today’s competitive market, automation is essential for active management firms to stay ahead. Many firms struggle with disorganized data and manual processes, diverting resources from high-impact strategies. Our Research Management Solution (RMS) offers seamless Microsoft Office integration, centralized data access, enhanced search, and AI-powered features, streamlining workflows and driving better investment outcomes.

-

ResearchPool RMS – Simplifies Investment Management

Many professionals struggle to quickly find internal research, especially in investment management, where data is often disorganized and spread across multiple systems. The complexity of managing numerous issuers, securities, and identifiers adds to this challenge. To address this, Our Research Management Solution offers features like enhanced issuer search, unified content aggregation, customizable data fields, seamless…

-

ESMA Believes Substantiated Engagement Claims Are Necessary

The European Securities and Markets Authority (ESMA) highlighted the need for substantiating ESG engagement with solid evidence. Many investment firms face challenges in proving engagement due to Excel’s limitations in data management and automation. ResearchPool’s solution streamlines ESG tracking, offering seamless integration, enhanced data integrity, comprehensive audit trails, and automated workflows, ensuring effective and verifiable…

-

Stop Missing Unique Investment Opportunities with ResearchPool Research Management Solution (RMS)

Stop Missing Unique Investment Opportunities with ResearchPool Research Management Solution (RMS) Feb 26, 2024 — by ResearchPool in Insights At many investment firms, valuable content and data collected, and research created by portfolio managers and analysts are often managed individually, with limited workflow automation, sharing, and collaboration. This traditional approach usually involves sharing information via…

-

Boost Efficiency & ROI – The Antidote to Asset Erosion in Active Management

Investors are actively managing equity funds since 2022. Active management must become more cost-competitive and innovative, leveraging human knowledge and decision-making. Our solution empowers firms to be leaner and more agile, using Microsoft technology to create automated, customizable workflows for faster, better investment decisions. Schedule your demo now.

-

Making ESG Engagement Reporting at Fund Level Easy!

New regulations require investment managers to report engagement activities at the fund level. Achieving this is complex due to data quality issues, ticker variants, and mismatches with fund holdings. ResearchPool offers an automated solution with ticker mapping and robust aggregation, streamlining ESG engagement reporting and saving significant time and effort.

-

Is ESG Stewardship Under-Resourced? An alternative View…

Investment managers and asset owners recognize the need for increased stewardship resources, as current efforts are inadequate. Addressing this can involve adding extra headcount or using ResearchPool, which automates workflows, organizes stewardship activities, and ensures superior data management. This improves collaboration, reporting, and ultimately benefits investors.

-

Unlock your Data Silos for Better Investment Returns

Portfolio managers and analysts often face inefficient workflows and missed collaboration opportunities due to local storage of investment indicators. Our data solution centralizes indicator management, offering advanced user interfaces and connectivity, streamlining workflows, and eliminating duplicated efforts across your organization.

-

European Investments with Our Sell Side Research API

European Investments with Our Sell Side Research API Feb 26, 2024 — by ResearchPool in Insights European stocks are currently enjoying a surge in interest among international investors seeking promising investment opportunities beyond the U.S. market. As the demand for insightful investment strategies grows, European sell-side analysts stand at the forefront, offering invaluable perspectives that…

-

ESG Engagement Tracker : MS Excel Not Fit-for-Purpose

ESG Engagement Tracker : MS Excel Not Fit-for-Purpose Feb 26, 2024 — by ResearchPool in Insights While MS Excel has gained popularity as ESG Engagement Tracker due to its flexibility. It has many important shortcomings including: Access & Retrieval: Users often struggle to keep track of MS Excel file names and their location in mailboxes…

-

Active Asset Management : Unlock Sustainable Business Model

Active Asset Management: Unlock the Sustainability of Your Business Model Feb 26, 2024 — by ResearchPool in Insights The current profitability challenges faced by active asset management firms impose rapid cost reduction and significant productivity improvements to achieve sustainable business models. These firms are under immense pressure to streamline their operations and enhance efficiency to…

-

Better Investments: Going from 20 to 80 in Data Capture and Knowledge Creation

Investment professionals generate valuable insights daily, but much of it is lost in the clutter of emails, spreadsheets, and documents. ResearchPool offers a centralized repository to capture and tag this data from various platforms like Outlook and Teams, fostering collaboration and enabling easy retrieval for informed investment decisions.

-

How to Achieve Painless Financial & ESG Reporting at Issuer and Fund Levels?

Investment managers grapple with the arduous task of consolidating and refining data for financial and ESG reporting, facing productivity drains and regulatory jeopardy. The crux lies in aligning data with issuers and funds across diverse financial instruments and exchanges. Our solution automates this process, ensuring clean, organized data for seamless reporting and risk mitigation.

-

Turning your Investor Relations Website into a One-Stop-Shop for Investors and Shareholders

Transform Your Investor Relations: Simplify access and enhance investor engagement with ResearchPool widgets. Streamline information retrieval, reduce manual workload, and gain valuable insights into investor interests. Elevate your company’s value perception seamlessly. Contact us now to revolutionize your investor relations experience.

-

Investment Research: A Valuable Asset?

In today’s investment landscape, internal investment research is crucial for informed decisions and client satisfaction. Yet, assessing the efficacy of research spending remains a challenge. At ResearchPool, we offer a comprehensive solution to quantify impact, optimize spending, and prioritize value. Gain insights, streamline access, and elevate your strategy with our platform.

-

Investment Process Reliability: One of the keys to winning RFPs from Asset Owners

Asset owners prioritize the robustness of investment processes when selecting asset managers. However, crucial decision-making steps often remain informal, scattered across various mediums like emails, notes, and documents, lacking digitalization and unified workflow. This fragmentation may lead to doubts about efficiency and reliability, despite managers’ expertise. Customizable attributes and audit trails enhance transparency.

-

ESG Controversies : A Detailed Identification is Must-Have!

As investor scrutiny intensifies and regulatory frameworks evolve, asset managers face heightened pressure to swiftly identify and address ESG controversies. Mere reliance on raw data won’t suffice; comprehensive processes are imperative. Consider the exacting standards of the French ‘ISR’ Label, mandating meticulous controversy scrutiny and responsive action. ResearchPool’s solution offers automated, robust procedures, meeting investor…

-

Uncover Investment Opportunities on EU stocks via our Sell-Side Research API

Amidst the current financial landscape, European stocks are emerging as a beacon of opportunity for global investors seeking alternatives to the overheated U.S. market. In this dynamic environment, European sell-side analysts stand at the forefront, armed with invaluable insights crucial for successful investments. Our Sell Side Research API offers investment firms unparalleled access to this…

-

Ready for EU Regulatory Crack Down on ESG Engagement in 24?

The AMF (French financial regulator) has set forth its 2024 supervision priorities, emphasizing the need for stringent actions against misguided ESG Engagement & Voting policies. This crackdown aims to impose repressive measures, especially in cases where investors suffer harm. With the growing significance of ESG engagement and voting policies on investment managers’ conduct and business…

-

Markit Hub Transition to ResearchPool: Shaping the Use of Investment Research Insights.

Markit Hub Transition to ResearchPool: Shaping the Use of Investment Research Insights. Feb 26, 2024 — by ResearchPool in Insights Investment research is and will be a key source of knowledge for active management. The actionable insights provided by the highly skilled sell-side and independent analysts may determine the level of success of an investment…

-

Reference Data is the Foundation for Quality Investment Decisions!

Transforming raw financial data into actionable insights demands a sturdy reference data framework encompassing intricate details of each financial instrument, including identifiers, classifications, and codes, along with clear linkages to issuers. This arduous task, typically undertaken at investment firm levels, entails a collaborative effort involving multiple individuals investing countless hours in data mining, cleansing, aggregation,…

-

How to Unlock the Intrinsic Value of Sell-Side Research with Generative AI?

Sell-side investment research reports are often seen as undifferentiated products, flooding the market particularly in large caps. However, these reports are crafted by skilled professionals, capable of converting data into valuable insights. The challenge lies in users’ capacity to process and act on the abundance of available information. Generative AI emerges as a solution, leveraging…

-

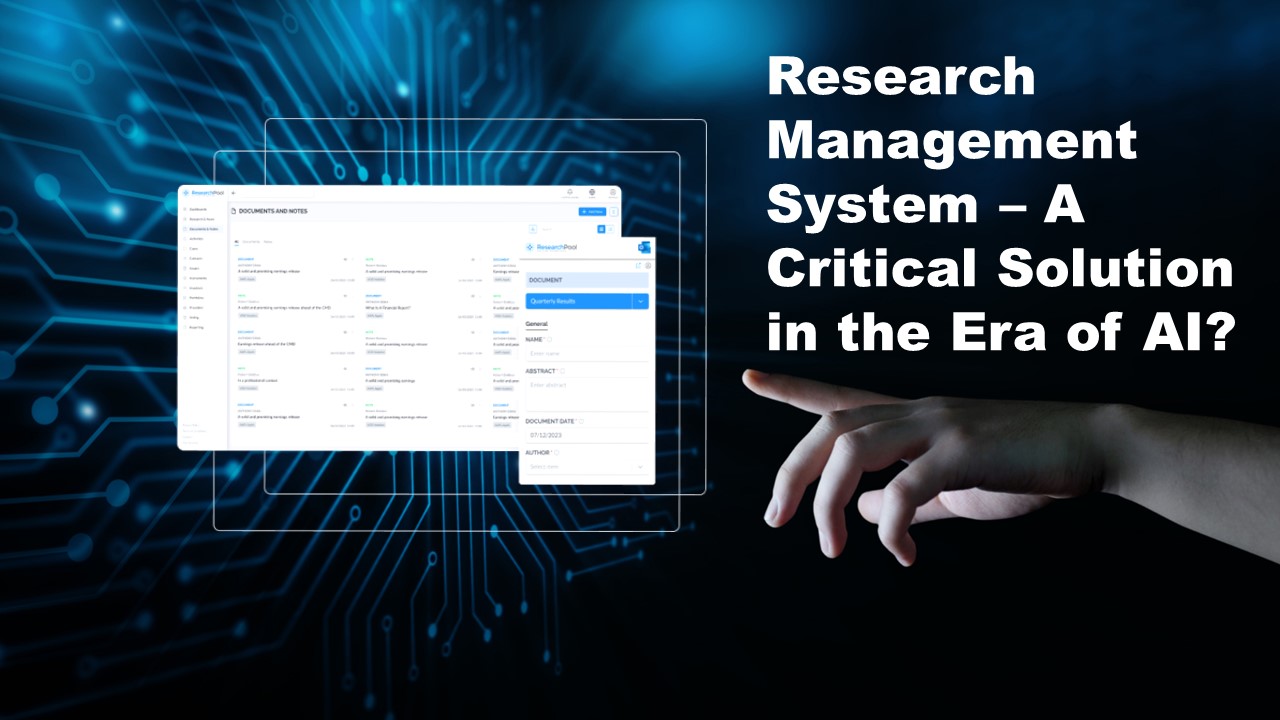

Research Management System – A Critical Solution in the Era of AI?

Research Management System – A Critical Solution in the Era of AI? Feb 26, 2024 — by ResearchPool in Insights For many organizations, content, and data are just standalone and uncategorized artifacts scattered across emails, shared folders, sheets, notes, documents, and more. Consequently, the generation and sharing of information are significantly constrained. It is also…

-

Boldness: The Antidote to Shifting from Active to Passive

Amidst the industry’s shift towards cheaper passive strategies, active management’s allure persists, especially in the expanding realm of passive investments. To thrive, a recalibration is imperative—embracing a leaner operational model. This involves scrutinizing costs, enhancing productivity, and perpetual refinement. Proposed actions include evaluating cost-effective alternatives, digitalizing workflows with generative AI, and fostering internal collaboration. In…

-

Reduce Regulatory and Reputation Risks by Elevating the Digitalization of Your Engagement and Investment Processes

In the asset management industry, digitalization of engagement and investment processes is imperative due to heavy regulation. While many firms have some documentation in place, it’s often incomplete and disorganized, making auditing challenging. Our “Case” solution integrates with Microsoft Office Suite, allowing easy tagging and uploading of relevant content into a centralized repository. This includes…

-

ESAP – A Game Changer for Financial and Sustainable Data in Europe (as of 2026)

By mid-2026, Europe will introduce European Single Access Point (ESAP), a centralized database managed by ESMA, offering regulatory information from various capital markets stakeholders. Modeled after the SEC’s EDGAR in the US, ESAP aims to provide a comprehensive resource for investors, facilitating access to both human and machine-readable data. This initiative is poised to foster…

-

Countdown to New ESG Label Rules in France (March 1)

Implementation of new rules for the French ESG label on March 1, the need for robust data integrity and streamlined workflows has become paramount. Traditional tools like MS Excel fall short in meeting these demanding obligations. ResearchPool offers a comprehensive solution with seamless integration into Microsoft Office, ensuring usability and efficiency. Its customization capabilities allow…